Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Signal: The USDA just made many agrivoltaic projects ineligible for key federal loan support—especially ground-mount >50 kW and projects without historical on-farm energy use. Wind/solar are out of one major loan program entirely. Body blow—not a knockout.

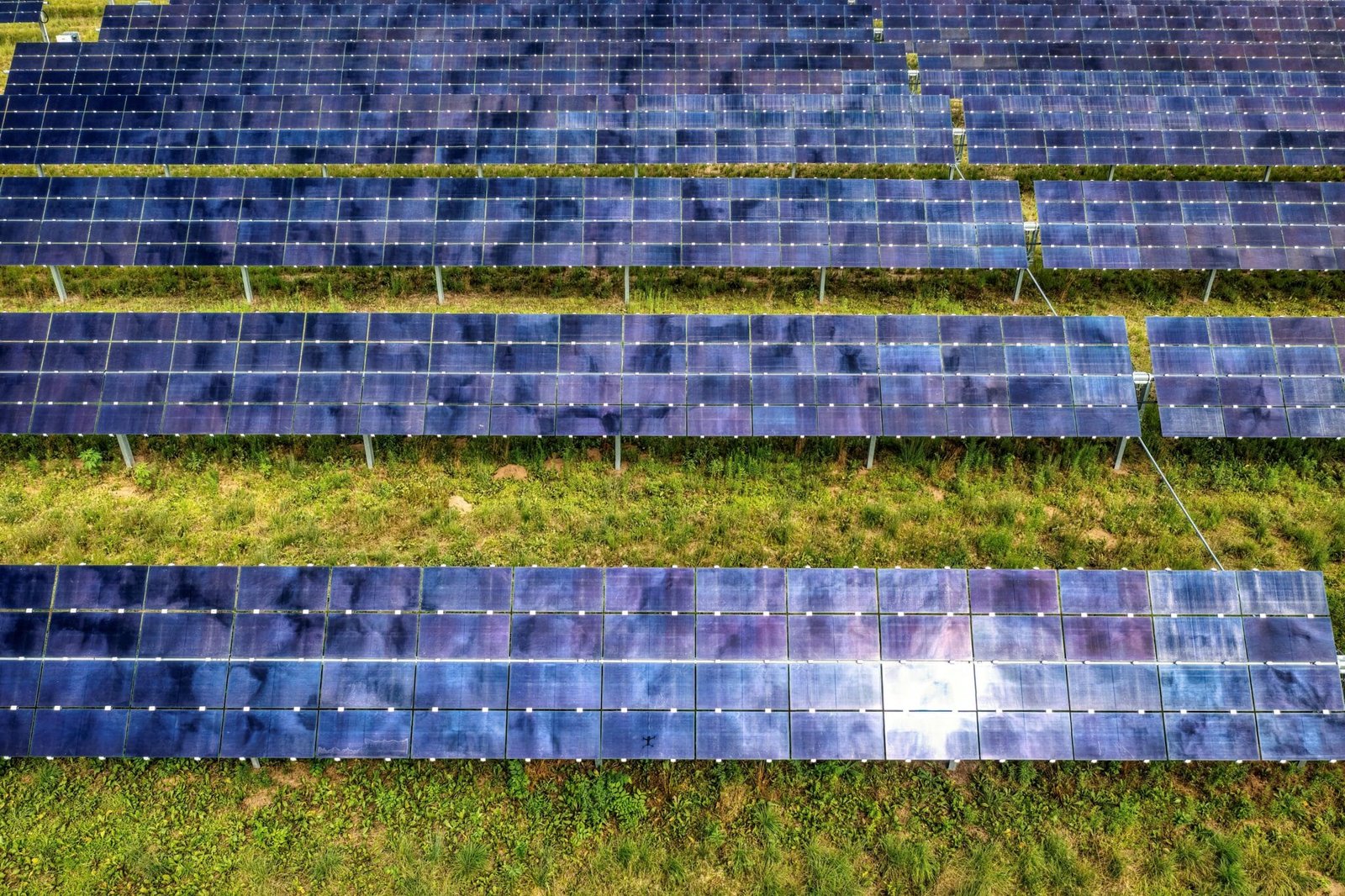

Agrivoltaics in the U.S. is no sideshow: ~10 GW of agriPV and ~60k acres were already operating by late 2024—grazing, crops, pollinator habitat, greenhouses, the works. The pipeline exists because dual-use solves real land-use politics. Financing friction slows it, but doesn’t erase it.

Reality check: Even USDA-linked studies show solar still occupies a tiny fraction of U.S. farmland, often coexisting with agriculture. The narrative that PV “displaces agriculture” is… oversold.

B&I: If your project is wind/solar on farmland, don’t count on B&I loan guarantees anymore. Re-model your capital stack.

REAP loans:

50 kW ground-mount = ineligible

No historical on-farm load data = ineligible

Foreign-adversary panels = ineligible

Grants may still exist but are deprioritized in several cases—assume higher scrutiny.

This is a playbook moment: when central support tightens, resilient agriPV projects pivot to stacked revenue (power + grazing + habitat), modular phasing, and non-federal capital. Those muscles are useful everywhere—Australia, India, Europe. (Also: the “food vs. solar” trope is global. Build your counter-narrative with facts.)

Programs hit: B&I loan guarantees (wind/solar out); REAP guarantees restricted for >50 kW ground-mount and no historical energy use.

Scale today: ≈10 GW U.S. agriPV by late 2024; ~600 sites across grazing/crops/pollinator/greenhouse.

Land share: Solar still occupies a sliver of U.S. farmland; often coexists with ag according to USDA-linked/Reuters analysis.

This isn’t about land. It’s about narrative control and program levers. The fastest counter is designing for farm economics (not just PPA yield), documenting load reality, and shifting debt sources. Agrivoltaics thrives when it looks like farming with a power side-hustle, not power with a farm aesthetic.